nikifar.ru Market

Market

1891 Dollar Coin Value

Continued collector demand and higher bullion prices combine to raise your Morgan silver dollar value to a minimum of $ each. Silver value of these. If the item is not returned in its original condition, the buyer is responsible for any loss in value. within 7 days. Get postage cost. There was a problem. The Morgan Silver Dollar was a high-mintage, generally low-quality issue for the series. The strike is average or below, but not often sharp. S Morgan Silver Dollar pictures, mintage, facts, and information. Value of S Morgan Silver Dollar. The designer was George T. Morgan for PCGS # Visit to see edge, weight, diameter, auction records, price guide values and more for this coin. P GREAT DATE MORGAN SILVER DOLLAR 90% $1 COIN US #Y $ $ shipping. 15 bids. 18h 44m. USA Coin Book Estimated Value of Morgan Silver Dollar is Worth $51 in Average Condition and can be Worth $ to $2, or more in Uncirculated (MS. The Morgan Silver Dollar value ranges from the hundreds to tens of thousands of dollars. This coin is common and relatively easy to find in most grades. In-depth overview of the Morgan Silver Dollar, including its key features, value and how to appropriately judge the coins condition. Continued collector demand and higher bullion prices combine to raise your Morgan silver dollar value to a minimum of $ each. Silver value of these. If the item is not returned in its original condition, the buyer is responsible for any loss in value. within 7 days. Get postage cost. There was a problem. The Morgan Silver Dollar was a high-mintage, generally low-quality issue for the series. The strike is average or below, but not often sharp. S Morgan Silver Dollar pictures, mintage, facts, and information. Value of S Morgan Silver Dollar. The designer was George T. Morgan for PCGS # Visit to see edge, weight, diameter, auction records, price guide values and more for this coin. P GREAT DATE MORGAN SILVER DOLLAR 90% $1 COIN US #Y $ $ shipping. 15 bids. 18h 44m. USA Coin Book Estimated Value of Morgan Silver Dollar is Worth $51 in Average Condition and can be Worth $ to $2, or more in Uncirculated (MS. The Morgan Silver Dollar value ranges from the hundreds to tens of thousands of dollars. This coin is common and relatively easy to find in most grades. In-depth overview of the Morgan Silver Dollar, including its key features, value and how to appropriately judge the coins condition.

Coin Values ; MS -- ; MS $, ; MS $4, ; MS $1, ; MS $

Coin Info · 8,,; $35+ · CC: 1,,; $+ · O: 7,,; $35+ · S: 5,,; $35+ · Proof: ; $3,+. CC Morgan Silver Dollar Value The CC Morgan dollar is one of the few dates from the Carson City Mint to actually enter commerce soon after being. This Coins & Money item is sold by vierksfinejewelry. Ships from United States. Listed on 19 Jul, $ is the rounded silver value for the silver Morgan dollar on August 28, This is usually the value used by coin dealers when selling. According to the NGC Price Guide, as of August , a Morgan Dollar from in circulated condition is worth between $ and $ However, on the open. The Morgan Silver Dollar was a high-mintage, generally low-quality issue for the series. The strike is average or below, but not often sharp. The CC Morgan silver dollar is a precious remembrance of the Old West - where Morgan dollars saw their greatest use. Nearly all specimens show weakness in one area or another and some show flat centers. Sharply struck coins do exist, however, and can be found. Luster ranges. Description: Morgan silver dollar collectors not only respect the value of the Morgan but also how it came to be. The Morgan was in production from Morgan Silver Dollar · Coin Values. How we determine coin values. Typical coin prices in USD based on grade/condition. Compare All · MS $57, MS series of Dollars in the U.S. Coins contains 3 distinct entries with CPG® values between $1, and $57, The O is one of the Morgan dollar varieties with an exceptionally great difference in price be-tween MS and MS grades. At certain times on the market. The Value of an Morgan Dollar. Truly nice Morgan dollars can be found, but the majority have poor strikes and luster. This limits the number of coins. Early Silver Dollars USA Coin Book Estimated Value of O Morgan Silver Dollar is Worth $52 in Average Condition and can be Worth $ to $4, or. S Morgan Silver Dollar. Better Date, AU+ Details. Uncirculated. Blast White! Great Coin! We're going to explore the difference condition can make to the value of a coin. And we'll look at some of the rare and valuable Mint errors out there. nikifar.ru estimates the value of a Morgan Silver Dollar in average condition to be worth $, while one in mint state could be valued around. The S Morgan dollar is usually well struck and lustrous, with good eye appeal. Occasionally, a collector may encounter a specimen with some spotting. Period, United States of America - ; Coin type, Circulation coins ; Denomination, 1 dollar ; Melt value, XAGg x = USD ; Year, Was given this Morgan dollar as a tip. Not knowledgeable of coins but from my research this coin seems to be in very good condition, found.

Should You Buy Silver Now

Considering the rise in prices, silver investment can be a good option for long-term investors. Hence, a large number of people have started opening up to the. According to the BaC, India has been the bright spot in the world market for silver demand in , buying record amounts of the precious metal over the summer. Silver is the best electrical conductor and highly reflective, and so lends itself brilliantly to the renewable energy market. Between 20global. As investors seek avenues to diversify their portfolios and safeguard against economic uncertainties, silver emerges as a compelling investment option. Delving. Silver is a common investment when the stock market has a less than positive outlook, in times of economic recession or political instability. Based on the fact. Societies, and now Should You Invest in Oil and Gas Companies? Consider These 3 Risks. Related Terms. Gold and Silver Bullion: What It Is and How to Invest. Should I buy silver now, or wait? Many experts believe that silver has a bright future because of its high demand, so waiting to secure yours could be risky. Does a recommendation of 5%% of holdings in gold include your silver holdings, or is it in addition to a silver allocation? And is % the right number? Silver is cheaper per ounce and has larger industrial applications whose demand may be affected more by a forecasted recession. Both are generally considered. Considering the rise in prices, silver investment can be a good option for long-term investors. Hence, a large number of people have started opening up to the. According to the BaC, India has been the bright spot in the world market for silver demand in , buying record amounts of the precious metal over the summer. Silver is the best electrical conductor and highly reflective, and so lends itself brilliantly to the renewable energy market. Between 20global. As investors seek avenues to diversify their portfolios and safeguard against economic uncertainties, silver emerges as a compelling investment option. Delving. Silver is a common investment when the stock market has a less than positive outlook, in times of economic recession or political instability. Based on the fact. Societies, and now Should You Invest in Oil and Gas Companies? Consider These 3 Risks. Related Terms. Gold and Silver Bullion: What It Is and How to Invest. Should I buy silver now, or wait? Many experts believe that silver has a bright future because of its high demand, so waiting to secure yours could be risky. Does a recommendation of 5%% of holdings in gold include your silver holdings, or is it in addition to a silver allocation? And is % the right number? Silver is cheaper per ounce and has larger industrial applications whose demand may be affected more by a forecasted recession. Both are generally considered.

(For advice on buying gold and silver, check out our gold investment advice on how to invest in gold, and see our silver bullion catalog for some great silver. That means it has a somewhat stronger correlation with assets that could drive down its value in times of poor market performance. Easier Storage. Should you. Ideally under this situation, the ratio of Gold to Silver price may be expected to drop in around It will then be worth buying Silver in. However, silver may still be a great investment option, as it's a physical asset with intrinsic value and can be used to protect your current savings. Platinum. Gold vs Silver: 4 Key Differences You Should Know · 1. Silver May Be More Tied to the Global Economy · 2. Silver Is More Volatile than Gold · 3. Gold Has Been a. It's a reliable investment that could be helpful if you needed to sell off metal to make a smaller purchase or if you wanted to give precious metals as a gift. Silver ETF is a much more cost efficient way of investing in silver as there is no risk of impurities, no maintenance and no storage costs. They can be much. The lower price of silver allows people to take less of a financial risk up front and feel more comfortable spending money on a new type of investment. As you. Should I buy silver now, or wait? Many experts believe that silver has a bright future because of its high demand, so waiting to secure yours could be risky. Societies, and now Should You Invest in Oil and Gas Companies? Consider These 3 Risks. Related Terms. Gold and Silver Bullion: What It Is and How to Invest. There's many reasons to buy silver bullion. Silver is a safe haven protecting against inflation and can be held outside the financial system. Should you invest in silver? Yes. Silver as a means of storing money as a slab of bullion or as a series of coins is good because anywhere. Many investors spend time deciding whether to buy gold or buy silver, however the savviest investors own both. Whereas gold could offer the ultimate. 1 Ounce Silver Bars/Rounds are Great for: New precious metal investors, who aren't looking to spend a ton of money but want to buy as close to spot price as. Gold and silver can protect your money from inflation, which means even when prices go up, the value of these metals often stays strong. They are also. Silver is an affordable precious metal compared to gold: which is what often makes it a first choice for many savers and investors as they can buy more silver. Adding silver to your investment portfolio can offer diversification benefits. Precious metals often move inversely to stocks and bonds, meaning when the stock. Both gold and silver are a very practical hedge against inflation and have shown great resilience against periods of economic downturn. Buying either of these. Should I Buy Silver as well as Gold Bullion? Many investors spend time deciding whether to buy gold or buy silver, but the savviest investors own both. While. The answer to the question of investing in silver is yes. You should be investing in silver and here are 7 reasons that will show you just why it can be a good.

How To Start My Own Financial Advising Company

Prospective financial planners can start their career journey by studying financial topics, networking, and setting personal goals. Although corporations. own finances. For this reason, and the reasons we have already mentioned, every advisor in the company has their own financial advisor. Talk to a Christian. 12 Steps to Starting a Financial Advisor Business. 1. Figure out your Niche. The financial and investment advisor industry can be very competitive, so you have. Founder, Curtis Financial Planning. “When I felt called to launch my own financial planning firm, I had no idea where to start. I started looking at the. Will I work directly with you or someone else in your firm? What other investing, stock market, financial advisors, money, personal finance, financial. Creating an LLC for your financial advisor services is an excellent way to protect your assets and ensure the longevity of your company. This company. 9 Tips for Creating a Financial Advisor Business Plan · Don't Treat The Business Plan As A Static Document · Keep Displacement In Mind As You Create It. Financial planning is the process of creating a comprehensive plan to save and budget money for your future. It involves proactive planning for life's major. By all means, yes, you should start from a bigger firm. · A bigger firm would provide you with better resources and the name itself would give. Prospective financial planners can start their career journey by studying financial topics, networking, and setting personal goals. Although corporations. own finances. For this reason, and the reasons we have already mentioned, every advisor in the company has their own financial advisor. Talk to a Christian. 12 Steps to Starting a Financial Advisor Business. 1. Figure out your Niche. The financial and investment advisor industry can be very competitive, so you have. Founder, Curtis Financial Planning. “When I felt called to launch my own financial planning firm, I had no idea where to start. I started looking at the. Will I work directly with you or someone else in your firm? What other investing, stock market, financial advisors, money, personal finance, financial. Creating an LLC for your financial advisor services is an excellent way to protect your assets and ensure the longevity of your company. This company. 9 Tips for Creating a Financial Advisor Business Plan · Don't Treat The Business Plan As A Static Document · Keep Displacement In Mind As You Create It. Financial planning is the process of creating a comprehensive plan to save and budget money for your future. It involves proactive planning for life's major. By all means, yes, you should start from a bigger firm. · A bigger firm would provide you with better resources and the name itself would give.

Whether your business is young or has been in existence for several years, a business financial advisor should be part of your team. Do your research, look. I see a gap in financial planning that no one has filled, so I'm going to start my firm because I know I can do better!" Starting your own firm is extremely. To seek out these influential professionals, see if you can get your clients or people from your personal network to refer you to their accountants, lawyers. Due to the conflict of interest inherent in these transactions, these advisors may have difficulty putting the client's interest above their own. NAPFA's. Learn how to set up a successful financial advisory business. Explore the positives and negatives, costs, earnings and our business plan. It's not a requirement, but it can be helpful in understanding the financial industry. Gain work experience: Many financial advisors start their careers in. Aspiring financial planners typically start out by getting a job supporting an existing firm. Eventually, after receiving mentoring and learning the system, you. Our advice goes beyond investing―it's guidance for all the moments that matter. Schedule a call. Or call to get started. Before tapping into your own assets or taking out a small business loan, consider researching alternative funding options such as angel investors or. 1. Take and pass the Certified Financial Planner exam offered by the Certified Financial Planner Board of Standards. · 2. Obtain a Registered Investment Advisor. Financial Planning For Small Businesses Can Help Protect Your Personal Wealth · Do you have enough cash flow? · Is your asset/liability ratio balanced? · Do you. 1. Name the financial adviser business. · 2. Register the financial adviser business with the secretary of the state. · 3. Contact the department of business and. Your Schwab Financial Consultant will help you understand where your money is invested, how your investments perform and offer guidance based on your needs. A personal experience that relates to your client's financial goals, or use a case study to illustrate how you helped a previous client achieve their objectives. Forming your own registered investment advisor (RIA) firm can allow you We help financial advisors bring their vision of independence to life. Hear. business, assist your clients with their financial and investment needs and meet your personal financial goals. A TRAINING PROCESS GEARED TOWARDS YOUR. MS-Personal Financial Planning; MBA-Accounting and Finance; MS As a firm representative your employer will submit this on your behalf. This. Because while most financial advisors are better at planning their clients' futures instead of their own, you can take charge and steer your business wherever. Trust is a big factor when selecting a financial planner. You can build this by emphasizing your years of experience, the number of clients your firm has helped.

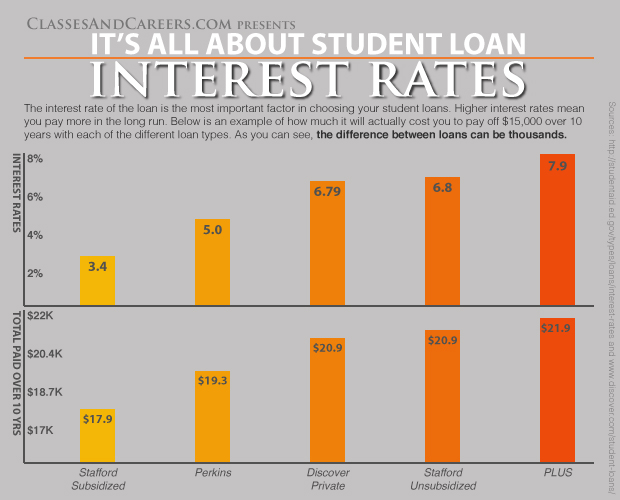

Student Loan Terms And Rates

Period of Study End Date: April 30th · Date six-month non-repayment period begins: May 1st · Date six-month nonrepayment period ends: October 31st · First loan. Interest rates on federal student loans are fixed, so they stay the same throughout your repayment term. Federal student loan rates are determined based on the. Stages of a Student Loan · Amount owing · Repayment start date · Payment amount · Payment method · Interest rate, and · How long it will take to pay back your loan. Subsidized loans are limited to students who demonstrate financial need. If you qualify for this type of loan, the government pays the interest while you attend. The loan term is 12 to 30 years, depending on the total amount borrowed. The monthly payment can be no less than 50% and no more than % of the monthly. For private student loans, the repayment term can range anywhere from years, depending on the loan. You'll be given a definite term for your loan when you. What interest rate will I pay? Effective April 1, , the Government of Canada has eliminated the interest charged on all Canada Student Loans. You continue. rates on Canadian dollar commercial loans made by the Bank in Canada. The Conditions available at nikifar.ru Be. Alberta Loans Prior to July 1, The floating rate is CIBC prime rate plus 1%, and the fixed rate is CIBC prime rate plus 2%. Period of Study End Date: April 30th · Date six-month non-repayment period begins: May 1st · Date six-month nonrepayment period ends: October 31st · First loan. Interest rates on federal student loans are fixed, so they stay the same throughout your repayment term. Federal student loan rates are determined based on the. Stages of a Student Loan · Amount owing · Repayment start date · Payment amount · Payment method · Interest rate, and · How long it will take to pay back your loan. Subsidized loans are limited to students who demonstrate financial need. If you qualify for this type of loan, the government pays the interest while you attend. The loan term is 12 to 30 years, depending on the total amount borrowed. The monthly payment can be no less than 50% and no more than % of the monthly. For private student loans, the repayment term can range anywhere from years, depending on the loan. You'll be given a definite term for your loan when you. What interest rate will I pay? Effective April 1, , the Government of Canada has eliminated the interest charged on all Canada Student Loans. You continue. rates on Canadian dollar commercial loans made by the Bank in Canada. The Conditions available at nikifar.ru Be. Alberta Loans Prior to July 1, The floating rate is CIBC prime rate plus 1%, and the fixed rate is CIBC prime rate plus 2%.

Estimated Student Loan Refinance Payment Examples ; Variable Rate Loans ; Term, Interest Rate, APR, No. of Payments, Monthly Payment ; 5 Year, % – %, %. As of Sep 01, , the day average SOFR index is %. Variable interest rates will fluctuate over the term of the loan with changes in the SOFR index, and. The best private student loan rates range from % APR to over % APR, depending on various factors - including your credit score, household income. Formulas for Federal Student Loan Rates ; Loan Type. Formula ; Undergraduate Direct Subsidized and Unsubsidized Loans. year Treasury plus % (capped at The Loan Repayment Estimator can help you estimate the monthly payments you will need to make to repay your Canada Student Loan or other government student. All loans are subject to an interest rate floor based on term: 5 year: %, 10 year: %, 15 year: % and an interest rate cap of %. If you enroll. Federal Direct Subsidized Loans ; Interest, Current interest rate %. Based on year Treasury bond yield plus percent. Interest rate not to exceed. This repayment phase is called Student Loan Consolidation. Any grants you received do not have to be repaid. Once you reach the end of your study period, you. Direct Unsubsidized Loan. Eligible undergraduate, graduate, and professional students. Up to $20, (minus any subsidized amounts received for the same period). The interest rate for unsubsidized Stafford loans made to graduate students is %. Rates are fixed for the life of the loan. (For more, see How Interest. You can now customize the payment terms of your full-time student loan(s) online, even if you are behind on payments. If you want to see what other repayment. Repayment begins at the end of the six-month non-repayment period. This is when you start making regular loan payments. Log in to your secure NSLSC account to. You have 6 months after you finish or stop your studies to start paying back your loan. During this partial exemption period, interest continues to accumulate. Federal student loans are made by the government, with terms and conditions that are set by law, and include many benefits (such as fixed interest rates). College loans are like any other loan in that you'll have to repay the principal with interest, though some offer favorable repayment terms. Interest rates. Your consolidation agreement shows: The details of your current outstanding Canada-B.C. integrated student loans balance. Your monthly payment and when it is. The current 30 day average SOFR index rate is %. Changes in the 30 day average SOFR index rate may cause your monthly payment to increase or decrease. The terms and conditions of these student loans are set by the lender. Interest rates may be fixed or variable, and may be higher than interest rates on federal. You could get Loans from both the Nova Scotia government and the government of Canada. Both have great borrowing terms: When it's time to repay, pay low or even. Features of MEFA Undergraduate Loans ; piggy bank icon. Fixed interest rates with no application or origination fees ; calendar icon. Repayment period of 10 or

Selling Ira

4-Step Process for Selling Your Investment Property. Step 1: Work with a real estate agent familiar with self-directed IRAs and place the property on the market. Additionally, sales charges or commissions are imposed to acquire or sell IRA investments. These sales charges or commissions are either added to the amount. I have a stock in Roth IRA that I want to sell. If it's a gain, is this taxable? · First, from regular contributions, not subject to tax or. Keep in mind that, depending on your account type, the sale may trigger a gain or loss for tax purposes. SEP IRA · (b). Non-retirement. Individual and. Prohibited transactions include these: Borrowing money from your IRA (for example, treating it as a margin account); Selling property to it; Using it as. While a cash account only lets you buy and sell securities with a traditional settlement period, a limited margin IRA might offer same-day settlement of trades. Selling property to it; Using it as security for a loan; Using IRA funds to buy property for personal use (not including the first-time home buyer exemption). Blog filled with education and insights for self-directed IRA investors. A traditional IRA is a way to save for retirement that gives you tax advantages. Contributions you make to a traditional IRA may be fully or. 4-Step Process for Selling Your Investment Property. Step 1: Work with a real estate agent familiar with self-directed IRAs and place the property on the market. Additionally, sales charges or commissions are imposed to acquire or sell IRA investments. These sales charges or commissions are either added to the amount. I have a stock in Roth IRA that I want to sell. If it's a gain, is this taxable? · First, from regular contributions, not subject to tax or. Keep in mind that, depending on your account type, the sale may trigger a gain or loss for tax purposes. SEP IRA · (b). Non-retirement. Individual and. Prohibited transactions include these: Borrowing money from your IRA (for example, treating it as a margin account); Selling property to it; Using it as. While a cash account only lets you buy and sell securities with a traditional settlement period, a limited margin IRA might offer same-day settlement of trades. Selling property to it; Using it as security for a loan; Using IRA funds to buy property for personal use (not including the first-time home buyer exemption). Blog filled with education and insights for self-directed IRA investors. A traditional IRA is a way to save for retirement that gives you tax advantages. Contributions you make to a traditional IRA may be fully or.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another broker (who may charge. An investment retirement account or IRA is a long-term Self-managed portfolios allow you to buy, sell, and trade through an online trading platform. His 3 children owned remaining shares. o Dad and each child created self-directed IRAs. Each IRA acquired 25% of foreign sales corp (FSC). o S corp entered into. trade unsettled proceeds to buy and sell securities in your IRA. Ready to place a trade? Choose an account. Then enter your order quickly and easily. Place a. When you sell stocks in your IRA, you won't owe income taxes or capital gains tax on the investment earnings provided they remain in the account. Since the. A traditional IRA is a way to save for retirement that gives you tax advantages. See IRA Resources for links to videos and other information on IRAs. IRS regulations don't allow transactions that are considered “self-dealing,” and they don't allow your self-directed IRA to buy property from or sell property. Taxation of Capital Gains. Federal tax law apportions capital gains into two different classes determined by the calendar. Short-term gains come from the sale. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Merrill offers a broad. Ready to plan for your future retirement by selling naked calls or trading futures in your IRA? If so, you'll need to start by upgrading* your trading level. Prohibited transactions in an IRA · Borrowing money from it · Selling property to it · Using it as security for a loan · Buying property for personal use (present. IRAs. The investments in If you own stocks or stock funds within a traditional IRA or (k), you don't have to pay taxes on dividends or on stock sales. You've reached that magic age when the IRS requires you to take annual IRA withdrawals. Do Not Sell or Share My Personal Information. This is for persons in. Understanding the Mechanics of Selling Gold IRA Assets · Contact the Certified Gold Exchange at · Request a portfolio buyback. Financial professionals are sales representatives for the members of Principal Financial Group®. They do not represent, offer, or compare products and services. As income tax filing season approaches, the U.S. Commodity Futures Trading. Commission (CFTC) is warning investors to be cautious of sales pitches touting “IRS. Non-tuition fellowship and stipend payments included in gross income. Income sources not included as compensation for IRA purposes are: Profit from the sale of. selling some stocks or stock funds, preferably growth-oriented US equities. But if he were to eventually sell the once-depressed stock from the IRA at a. Siblings, ironically, are not disqualified persons, Specifically, the IRC prohibits any: sale or exchange between an IRA and a disqualified person;; loan or. Plan for retirement with IRAs. Explore IRA opportunities with USAA's trusted partner Charles Schwab Shares are bought and sold at market price, which may be.

Investment Chart

Find Stock quotes, charts, reports, news and more for all your favorite stocks. Invest with TD according to your financial plan and outlook. An investment cannot be made directly in an index. © Morningstar and This graph illustrates the hypothetical growth of inflation and a $1. The chart of the week uses economic data to address timely market topics from Wells Fargo Investment Institute Global Investment Strategy team. Use the chart maker to display the value of a $10, investment for any stock, exchange-traded fund (ETF) and mutual fund listed on a major U.S. stock exchange. The chart shows annual returns for eight asset classes against a diversified portfolio. Diversification works to smooth out those big swings in the short-term. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. This material does not take into. The Periodic Table of Investment Returns depicts annual returns for 9 asset classes, ranked from best to worst performance for each calendar year. View PDF. US stocks finished the last trading day of August on a positive note, as investors assessed key inflation data closely watched by the Federal Reserve. Add efficiency to research workflows with pre-built comparison tables, charts & screens, and investment analysis tools built for wealth management use cases. Find Stock quotes, charts, reports, news and more for all your favorite stocks. Invest with TD according to your financial plan and outlook. An investment cannot be made directly in an index. © Morningstar and This graph illustrates the hypothetical growth of inflation and a $1. The chart of the week uses economic data to address timely market topics from Wells Fargo Investment Institute Global Investment Strategy team. Use the chart maker to display the value of a $10, investment for any stock, exchange-traded fund (ETF) and mutual fund listed on a major U.S. stock exchange. The chart shows annual returns for eight asset classes against a diversified portfolio. Diversification works to smooth out those big swings in the short-term. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. This material does not take into. The Periodic Table of Investment Returns depicts annual returns for 9 asset classes, ranked from best to worst performance for each calendar year. View PDF. US stocks finished the last trading day of August on a positive note, as investors assessed key inflation data closely watched by the Federal Reserve. Add efficiency to research workflows with pre-built comparison tables, charts & screens, and investment analysis tools built for wealth management use cases.

Step 1: Initial Investment. Initial Investment. Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount. Portfolio Charts explores practical index investing strategies using intuitive charts and real-world examples that look beyond the raw numbers. Explore CBRE's Chart of the Week for the latest market trends & economic data insights. These fees may seem small, but over time they can have a major impact on your investment portfolio. The following chart shows an investment portfolio with a. The current price of INVEST is EUR — it has increased by % in the past 24 hours. Watch INVESTORS HOUSE OYJ stock price performance more closely on the. Stock quote · Stock Quote: NYSE · Stock chart · Historical lookup · Investment calculator · Quick links · Email alerts · Contact IR. Investors with a written financial plan have better saving habits than those who don't. About this chart. View current Sun Life (SLF) share performance and chart up to 6 years of historical share prices Investment calculator · Share performance overview · Share. Investment Calculator · How Investing Works · How to Calculate Return on Investment (ROI) · Factors to Consider Before You Invest. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. This material does not take into. This chart below shows annual returns for selected asset classes ranked from best to worst within each calendar year over the last years. Retail traders may make decisions based solely on the price charts of a security and similar statistics. But practicing equity analysts rarely limit their. How to use charts to make smarter investing decisions. Technical analysis education from the PROs. Stock Quote · Stock Chart · Historical lookup · Investment Calculator · Email Sign Up · Email Alert Sign Up Confirmation · Privacy Preference Settings. Chart Walmart first offered common stock to the public in and began trading on the New York Stock Exchange (NYSE: WMT) on August 25, We have. Professional money managers make investment decisions on behalf of fund investors, buying and selling investments such as money market investments, bonds and. Search from Investment Chart stock photos, pictures and royalty-free images from iStock. Find high-quality stock photos that you won't find anywhere. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Investing · Quotes · Index · DJIA; Advanced Chart. Market Screener · Market Indexes 41, %. Previous Close. 41, Chart Range. 1D 5D 10D. Step 1: Initial Investment. Initial Investment. Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount.

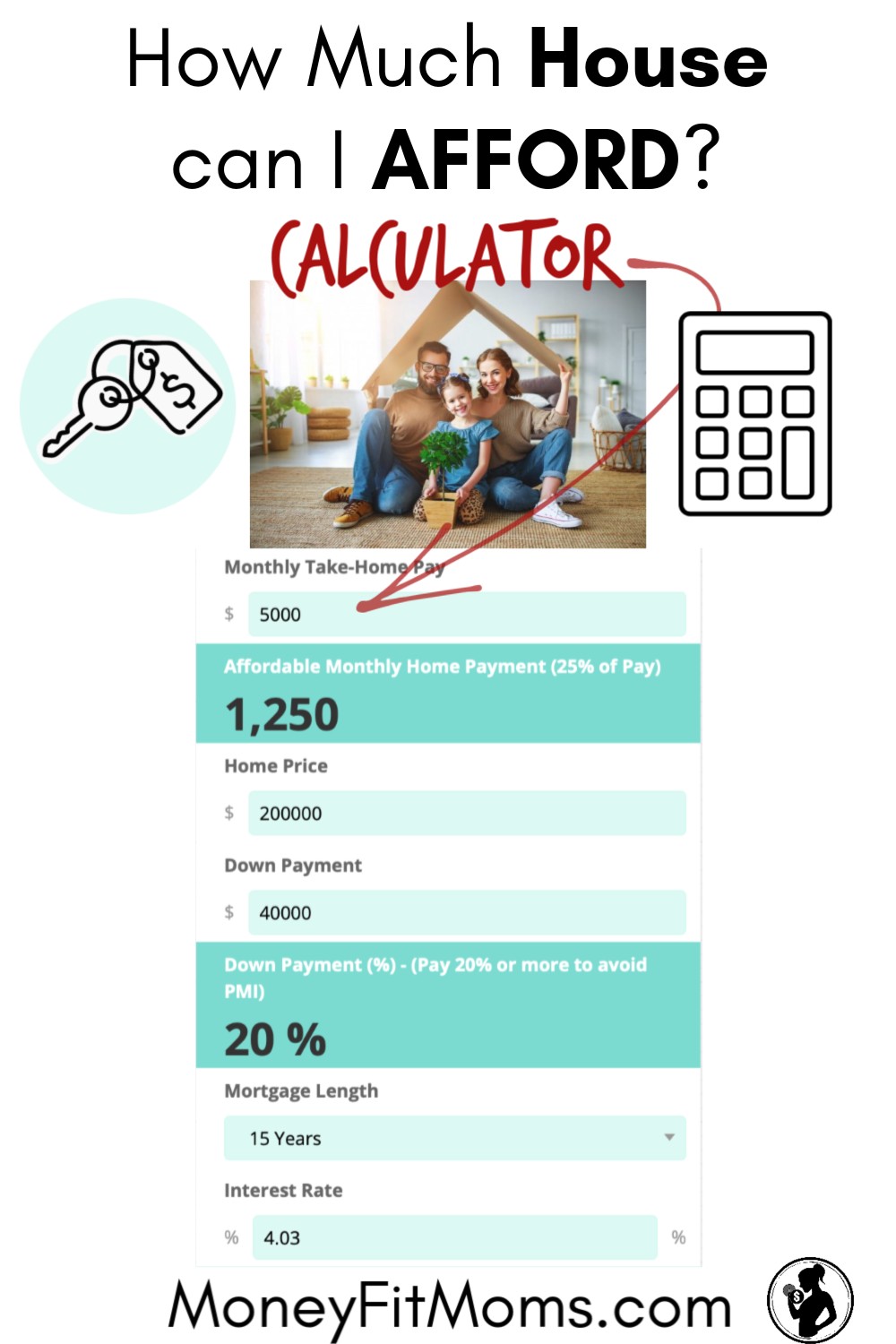

90000 Salary How Much House Can I Afford

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. k$ for a condo. Less if you are alone and look for something small. Totally doable for a 90k$ salary. I was approved with my 62k$ salary. Your total debt: This shouldn't exceed 40% of your gross income (mortgage, auto loan, credit cards, etc.). You can learn more about. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. These costs may be significant and may affect your affordability, debt-to-income ratio or monthly payment. How much house can I afford? To know how much house. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. k$ for a condo. Less if you are alone and look for something small. Totally doable for a 90k$ salary. I was approved with my 62k$ salary. Your total debt: This shouldn't exceed 40% of your gross income (mortgage, auto loan, credit cards, etc.). You can learn more about. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. These costs may be significant and may affect your affordability, debt-to-income ratio or monthly payment. How much house can I afford? To know how much house.

You can afford a $, house with a monthly payment of $2, Estimate how much house you can afford with our home affordability calculator. Today's. So you're making 90 k a year. and you wanna know how much house you can afford. Let's take a look. Now, conventional guidelines. will allow you to go up to 50%. The table below shows how the 28%/36% rule works, for example, if your monthly income is $5,, your monthly mortgage payment should be no more than $1, ($. Canada Mortgage Qualification. Qualifier to Calculate How Much Mortgage I Can Afford on My Salary. Canada Mortgage Qualification Calculator. The first steps. How much home can I afford if I make $90,? You can afford to pay $2, per month for a mortgage. That would be a mortgage amount of $, With a down. How much home can I afford if I make $90,? You can afford to pay $2, per month for a mortgage. That would be a mortgage amount of $, With a down. A down payment is a portion of the cost of a home that you pay up front. How much house can I afford? Determine how much house you could afford. Take. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. can I afford? How much do I need to make to afford a $, home? And how much can I qualify for with my current income? We're able to do this by not only. -- The sum of the monthly mortgage and monthly tax payments must be less than 31% of your gross (pre-taxes) monthly salary. -- The sum of the monthly mortgage. Find out how much you can borrow on a mortgage earning £90k, compare mortgage rates. All about mortgages from the experts at Ascot Mortgages. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for. You can afford a $, house. Monthly Mortgage Payment. Your mortgage payment for a $, house will be $1, This is based on a 5% interest rate and a. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. To afford a house that costs $90, with a down payment of $18,, you'd need to earn $19, per year before tax. The mortgage payment would be $ / month. What house can I buy with a 90k salary? On a $90, salary, you should be able to afford a home that ranges from $, to $, The better your credit. Input your net (after tax) income and the calculator will display rentals up to 40% of your estimated gross income. Property managers typically use gross income. How much to afford a $K house? With a 20% down payment at 5% interest rate you need to make roughly $90, – $95, Most mortgage lenders adhere to the. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. Let's find out. So if you make $, a year, that's $8, a month. And with a conventional loan, you can use about 36% of that gross income. for your house.

Nearest Pawn Shop Near Me

Find a local pawn shop near you by using our zip code search. You will find popular pawn shops in your area and details on what can be pawned. Hinahanap ang pinakamalapit ng Palawan Pawnshop branch? Gamitin ang aming walang kuskos-balungos na Branch Finder! Shop & Sell Items at Pawn America Pawn Shops Near You. Make money FAST & save thousands on fine jewelry, watches, video games, computers, electronics +. We regularly purchase musical instruments, cameras and electronics. If you have any valuable items just sitting around in your home collecting dust, it might be. Pawn Loans, and Cash for Gold. Come and see us for all of Please use the company Store Locator to find the nearest Cash Express Store closest to you. diamond rings, and pawn watches. 24/7 Pawn Shops Near Me Jewelry Pawn Shop Pawn and Sell Jewelry Gold, Silver, Platinum. Visit Milton Gold & Silver Exchange store in Milton located at Stewart St, Milton, FL and explore the latest short-term loans and offers. pawn shop near you. Browse our extensive pawn shop directory to find a local New York pawn shop closest to your home. of Looking for an excellent pawn shop that offers a great price for pre-owned merchandise? Look no further. Visit your nearest EZPAWN shop today! Find a local pawn shop near you by using our zip code search. You will find popular pawn shops in your area and details on what can be pawned. Hinahanap ang pinakamalapit ng Palawan Pawnshop branch? Gamitin ang aming walang kuskos-balungos na Branch Finder! Shop & Sell Items at Pawn America Pawn Shops Near You. Make money FAST & save thousands on fine jewelry, watches, video games, computers, electronics +. We regularly purchase musical instruments, cameras and electronics. If you have any valuable items just sitting around in your home collecting dust, it might be. Pawn Loans, and Cash for Gold. Come and see us for all of Please use the company Store Locator to find the nearest Cash Express Store closest to you. diamond rings, and pawn watches. 24/7 Pawn Shops Near Me Jewelry Pawn Shop Pawn and Sell Jewelry Gold, Silver, Platinum. Visit Milton Gold & Silver Exchange store in Milton located at Stewart St, Milton, FL and explore the latest short-term loans and offers. pawn shop near you. Browse our extensive pawn shop directory to find a local New York pawn shop closest to your home. of Looking for an excellent pawn shop that offers a great price for pre-owned merchandise? Look no further. Visit your nearest EZPAWN shop today!

We found 24 pawn shop locations in New York. Locate the nearest pawn shop to you - ⏰opening hours, ✓address, map, ➦directions, ☎️phone number. Pawn Loan Services - Pawns are a great way to borrow money fast on items you already own. Loans are based on the value of the item you bring in. We loan for most items of value – find your nearest store today. Find out With over stores around the UK, and ,'s of items online – all. I ran and owned pawn stores for nearly 35 years. From to late Today, stolen items show up on the nightly reports to law enforcement. Some of the best pawn shops open sunday near me are: Buy Sell Loan · Buy Sell Loan · Dynasty Jewelers. What are the most reviewed pawn shops open sunday near me. Found a little place nearby that recently opened up. Checked it out and feel like I made out well. r/Steelbooks - Buy 3 get 3 free. With over 30 years of pawn experience, we operate over locations nationwide. Find related places. Electronics Store. Second Hand Stores. seeing how retailer's prices compare to pawn shop prices, I will never shop retail again!!! pawnshops with SIX locations serving the. Get fast cash for your phone. Sell your old phone for cash at a ecoATM kiosk near you. Find the nearest ecoATM location now. Start Selling Online Now. Shop new or pre-loved goods online or at your closest store, at the best possible prices. +. Use this guide and map locator to locate a pawn shop nearby and see the tips for finding the best pawn shop near you for a short-term loan. Visit Prairies Edge Pawn store in Chadron located at Beech St, Chadron, NE and explore the latest short-term loans and offers. pawn stores with mote than 3, retail pawn and consumer Store Locator. With over 2, stores across North and Latin America, find your nearest store. At The Jewelers & Loan Co., we appreciate the history of gold and think there is a place for it in pawn shops, jewelry stores, and eventually even local banks. Cash America Loans 24/7. Pawn shops locations; Cash advance loans Start exploring the opportunities available at your nearest pawn shop today! Why Pawn Shops? You can get fast money or find terrific deals at Blue Sky Pawn & Cash or other nearby pawn shops. Other benefits you get from Blue Sky Pawn. How much does a pawn shop give me for an electric skateboard? Do pawn shops buy shoes? The ones near me do but they only take expensive. Home. Locations. All LocationsGlassboroPleasantvilleSomerdaleVineland Pawn Shop - Philadelphia. Philadelphia We Buy Everything Store Front. Image. Find related places. Department Stores. Shopping. Own this business. Department Stores. Shopping. Second Hand Stores. Antique Stores. Pawn Shop. Jewelry Store.

Make Money By Investment

The second is through investment appreciation, aka, capital gains. When your investment appreciates, it increases in value. Give me a simple example. Let's say. Businesses that consistently grow their equity are exceptional in their ability to invest in growth, making them valuable in the long run. Equity growth is a. Real Estate Investment: Investing in real estate involves capital appreciation and rental income through property ownership. You can consider. Through improving your financial literacy. As you become involved, practice healthy behaviors, build your skills and learn about investing, UK will deposit. There are many ways to invest — from safe choices such as CDs and money market accounts to medium-risk options such as corporate bonds, and even higher-risk. Before you take your first steps to reap the long-term rewards of investing, make sure your immediate finances are in order. Prioritise paying off any short-. How do you make money through investing? Your investments can make money in 1 of 2 ways. The first is through payments—such as interest or dividends. The. Investing in stocks is a great way to build wealth, although getting started can feel daunting for many beginners looking to get into the market. Be very honest with yourself (and your investment advisor, if you have one) about your risk tolerance. · Don't let greed and fear hurt your investment decisions. The second is through investment appreciation, aka, capital gains. When your investment appreciates, it increases in value. Give me a simple example. Let's say. Businesses that consistently grow their equity are exceptional in their ability to invest in growth, making them valuable in the long run. Equity growth is a. Real Estate Investment: Investing in real estate involves capital appreciation and rental income through property ownership. You can consider. Through improving your financial literacy. As you become involved, practice healthy behaviors, build your skills and learn about investing, UK will deposit. There are many ways to invest — from safe choices such as CDs and money market accounts to medium-risk options such as corporate bonds, and even higher-risk. Before you take your first steps to reap the long-term rewards of investing, make sure your immediate finances are in order. Prioritise paying off any short-. How do you make money through investing? Your investments can make money in 1 of 2 ways. The first is through payments—such as interest or dividends. The. Investing in stocks is a great way to build wealth, although getting started can feel daunting for many beginners looking to get into the market. Be very honest with yourself (and your investment advisor, if you have one) about your risk tolerance. · Don't let greed and fear hurt your investment decisions.

If you're like most Americans and don't want to spend hours on your portfolio, putting your money in passive investments, like index funds or mutual funds, can. We run a suite of investment funds offering reliable and accessible liquidity. Our funds borrow money from its limited partners for 24 hours to finance long-. make money. A mutual fund is a convenient and simple way for investors to help diversify their investments at generally low cost, but it takes a fair degree. You put in so much effort to earn money – isn't it time you had it work hard for you, too? You may feel like you're just beginning your investment journey. Passive income is money earned from sources other than a traditional job, requiring little time or effort. That includes earnings from rental properties. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . Investment banks impose a high fee based on the amount of the offering (usually % of the total deal). They earn millions of dollars in commissions as a. O'Neil's national bestseller How to Make Money in Stocks has shown over 2 million investors the secrets to successful investing. O'Neil's powerful CAN SLIM. Investment scams claim you'll likely make a lot of money quickly or easily with little to no risk — usually by investing in the financial markets. Interest: Bonds and other fixed-income investments earn returns in a slightly different way. These investment vehicles are essentially loans made to an. There is no guarantee that you'll make money from your investments. But if money to your investment over a long period of time. By making regular. Also keep in mind that when you invest you are playing the long game. You will not make money overnight but with time. It's also a good way to. make money. A mutual fund is a convenient and simple way for investors to help diversify their investments at generally low cost, but it takes a fair degree. According to the Pew Research Center, even among families who earn less than $35, per year, one-in-five have assets in the stock market. Investing is less. The national bestseller. Anyone can learn to invest wisely with this bestselling investment system! Through every type of market, William J. O'Neil's. If you and others begin to buy, stock prices will tend to rise, offering the potential to make a profit—and to reverse any “paper losses” those who stayed in. Build a budget that works for you Starting to invest with a small amount of money isn't an issue. However, it's important to know how much you can afford to. Investing in stocks is a great way to build wealth, although getting started can feel daunting for many beginners looking to get into the market. In the same vein, the longer you stay in the market, the more compound growth you can earn. Many of those who end up losing money in the market are those who. For example, if the market is rising, momentum investors will buy stock, and if the market is falling, investors will sell. Income investing. The goal of this.